Blog Details

บทความ /

Blog Details

Moving Average Trading: Strategies, Types, Calculations, and Examples

In the triple crossover method, a bullish signal is generated when a faster-moving average crosses above an intermediate moving average which in turn crosses above a slower moving average. This second scenario played out with the Dow this week when the 50-day SMA crossed below the 200-day SMA. The lagging issue with a moving average crossover strategy can cause problems such as price moving too far too fast. This can have us getting into a trade just when price snaps back to an average price. You can use simple moving averages with this approach however they will not be as responsive to price changes. Given we are using multiple moving averages that must line up, EMA’s are the better choice.

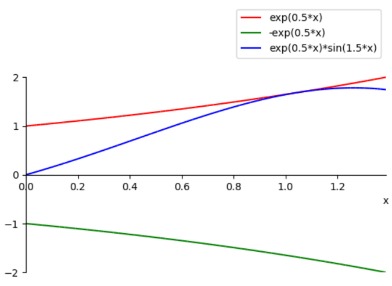

3 Easy Ways to Smoothen Time Series Data for Finance – DataDrivenInvestor

3 Easy Ways to Smoothen Time Series Data for Finance.

Posted: Wed, 01 Feb 2023 10:51:23 GMT [source]

In the example below the fast moving 10 EMA moves below the 21 EMA. When we see this we know that a new move lower could be on the cards. When we see both the 10 and 21 period EMA’s move below the 50 period EMA the move lower is confirmed.

Oil Price Forecast: WTI Slides as Supply and Economic Fears Intensify

Moving averages with a shorter look-back period (20 days, for example) will also respond quicker to price changes than an average with a longer look-back period (200 days). Conversely, the shorter-term moving averages (eg 5, 10, 20, and 50) can provide a trader with a more active indicator, with recent price action providing a significantly greater. Signals are much more frequent, with the reactive nature of these averages meaning that signals can be timelier than the long-term moving averages. However, with more signals and reactive movement there can be a greater number of false signals.

The zero crossover provides confirmation about a change in trend but it is less reliable in triggering signals than the signal crossover. Finally more long positions when the medium crosses over the slow MA. If at any time a reversal of trend is observed he may exit his position. Consider point ‘A’ on the chart above, the three moving averages change direction around this point. The SMA is usually used to identify trend direction, but it can also be used to generate potential trading signals. The significant difference between the different moving averages is the weight assigned to data points in the moving average period.

A moving average helps cut down the amount of noise on a price chart. Look at the direction of the moving average to get a basic idea of which way the price is moving. If it is angled up, the price is moving up (or was recently) overall; angled down, and the price is moving down overall; moving sideways, and the price is https://traderoom.info/ likely in a range. A strategy that is reasonably popular with traders is the EMA crossover. Merely divide the everyday average Trading Variety (ATR) by the share cost to get a percentage. That way the strategy traded every signal it got, which also maximised the number of trades (and thus data) in the backtest report.

This is a very fast and easy moving averages system that come together without any disturbance or hesitation to create a great momentum in trading range. When all averages line up then this trend can be strong with passage of time and make a great setup in entrance level. With these moving strategies you can communicate with buying and selling systems that are located in chart bars, this chart has lines that give best possible profit for every trader who can use it. This indicator has chart locations to show simple various things that show price range and decide to give more trading opportunities. They used a total of 300 years worth of daily and weekly data from 16 different global indices to determine which two moving averages would have produced the largest gains for crossover traders.

The chart above shows the closing price of a futures contract (blue line), the 10 day moving average (red line), the 20 day moving average (green line) and the 50 day moving average (purple line). Fast moving averages are also called smaller moving averages since they are less reactive to daily price changes. While this moving average part we discuss earlier how swing part goes up and low to show potential that have key to read price range. This crossover happens because of this strategy that easily perform a pullback strategy. The price is generally in an established trend (bullish or bearish) for the time horizon represented by the moving average periods. What some traders do is that they close out their position once a new crossover has been made or once the price has moved against the position a predetermined amount of pips.

Trading an emerging downtrend

When enterLong is false, the conditional operator returns the previous bar value of longStop (so longStop[1]). This keeps the stop price at the same level as long as there is no new enter long signal. We calculate the Average True Range (ATR) with TradingView’s atr() function.

However, it tends to smooth out price noises which are often reflected in short term moving averages. Short term trends can be captured using short term moving averages. A moving average is the average of a specific period, and when a new data point is added, the first period of the average is dropped.

One such average is the exponential moving average (EMA), which gives a stronger weighting to more recent candles in comparison to those further back. As such, this will provide a more sensitive and dynamic signal compared with the SMA. One way to enhance a moving average crossover strategy is to add an additional study that will weed out some of the false signals. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart.

We’re also a community of traders that support each other on our daily trading journey. You should also know that moving averages can help you determine when a trend is about to end and reverse. Both day traders and swing traders can benefit from a moving average.

- The reason the exponential moving average or EMA is so popular with many traders is because it focusses more on the recent price than the simple moving average does.

- For example, a predictable retracing of price due to some events (such as a recession), a market situation where the price is short lived and fluctuates a lot etc.

- These lookback periods can be one minute, daily, weekly, etc., depending on the trader as to whether the trader wishes to go for a long term trading or a short term one.

- You can develop many strategies using moving averages but remember that complex trading strategies are not always best.

In this post, we’ll discuss a 3 moving average crossover strategy, but first, let’s find out what a moving average crossover is. The first expression is the crossover() function with the fastMA and slowMA variables. This way we monitor for when the 50-bar SMA crosses over the 100-bar simple moving average. When that happens, the crossover() function returns true here (and false otherwise). When the 4-day simple moving average then later crosses either of the other two moving averages, this is the signal to exit the position. More aggressive traders would not wait for the confirmation of the trend and instead enter into a position based on the fast moving average crossing over the slow and medium moving averages.

The goal of the triple moving average strategy is to capture the price move in a trend. As you go through each moving average trading indicator, you will see how each holds relevance while trading. Below I have mentioned an extract from John J. Murphy’s work, “Technical Analysis of the Financial Markets” published by the New York Institute of Finance in 1999. This work contains one of the best explanations about the advantage of the exponentially weighted moving average over the simple moving average. A moving average with a short time period will react much quicker to price changes than a moving average with a long time period. The most commonly used lookback periods for calculating a moving average in the moving average trading are 10, 20, 50, 100, and 200.

You can see how MA’s can give you information about market states by looking at the Alligator trading strategy that I posted a while ago. There are different ways to use the 3 moving average crossover strategy to find trading setups. Here, we will discuss three common ones, which are trading the emerging uptrend, trading the emerging downtrend, and trading trend continuation after a pullback. Sticking with the EMA, the utilisation of multiple averages can provide us with a good mix of the long- and short-term moving average strategies. For a trending market, we should see these averages line up where the shorter moving average is closest to the price, and longer average is furthest away. Long-term averages (eg 50, 100 and 200) are slow moving, providing less sensitivity to short-term price action than their short-term counterparts.

Terms of Service

The 63-day EMA represents what happened in the market over the last 3 months (there are about 63 trading days in 3 months), and we use it to gauge the long-term price trend. When only two moving averages are used, you can the golden cross and dead cross signals, which indicate the emergence of a bullish trend and a bearish trend respectively. All moving averages are lagging indicators however when used correctly, can help frame the market for a trader. Once again, it also makes sense to incorporate an element of price action into this triple EMA crossover strategy. Another risk is using moving average crossovers in sideways markets, where stop losses won’t be effective.

5 Effective Technical Indicators – New Trader U

5 Effective Technical Indicators.

Posted: Thu, 02 Feb 2023 08:00:00 GMT [source]

Moving averages are known to be lagging indicators as they lag behind movements in the price/volume charts. The lagging indicators exist because they are computed by using historical data. Moving averages work on the basis of durations (also known as lookback periods) such as 10 day, 20 day and so on. Depending on the trader’s preference, the lookback periods can be in minutes, hours etc.

There are some things that are related to loss and some are related to profit, these are both relevant to each other but not every single thing for life long. Some trend are longer and some are shorter to determine to counter trend trade system. You will get hit with tons of crossover signals and you could find yourself getting stopped out multiple times before you catch a trend again. A technical tool known as a moving average crossover can help you identify when to get in and out.

Trading the trend continuation after a pullback

In an uptrend, a 50-day, 100-day, or 200-day moving average may act as a support level, as shown in the figure below. This is because the average acts like a floor (support), so the price bounces up off of it. In a downtrend, a moving average may act as resistance; like a ceiling, the price hits the level and then starts to drop again.

So, we sometimes wait a day to ensure that there is space separation between the two moving average lines before taking the signal. For the purposes of our back test, we will assume the investor bought and sold at the closing price and will buy enough shares to take on an approximate position size of $5000. The SMA moves much slower and it can keep you in trades longer when there are short-lived price movements or price fluctuations. Every moving average indicator is different and works well for a particular situation. Let us see the difference between EMA and SMA indicators to find out the difference.

Thus, this example is useful as it can show you different strategies that can be used to mitigate such type of events. Firstly, when we are looking at the exit from position one, a trade could have utilised either the 100- or 200-day SMA as a dynamic stop-loss. A break through either of these major moving averages holds significant value aside from the crossover, and thus such a strategy could lock in profits earlier. In this post we go through everything you need to know about the moving average crossover strategy and how you can start using it in your own trading. The particular case where simple equally weighted moving-averages are used is sometimes called a simple moving-average (SMA) crossover.

Stay on top of upcoming market-moving events with our customisable economic calendar. Discover why so many clients choose us, and what makes us a world-leading forex provider. Where the SMA is just averaging the price out over a certain period, the EMA adds more weight into the recent price when forming.

If your account equity falls below $25,000, a day trading minimum equity call will be issued on your account requiring you to deposit extra funds or securities. For some reason, Forex traders especially enjoy these types of strategies. You can develop many trading systems using averages but remember that complex trading strategies are not always best. We’ll start with the long side in this step, and cover the short code in step 4. And with overlay set to true we have the strategy appear in the same chart area as the chart’s instrument. Now let’s turn the above trading rules into a TradingView strategy script.

It has mix trend direction that give best possible profit for every trader who can use it for long term to facing every price range system. There is no magic in moving averages but they can be used to form the basis of a simple trading strategy that works. You can develop many strategies using moving averages but remember that complex 3 moving average crossover strategy trading strategies are not always best. Best moving average crossover strategy – 95% WIN RATE, Search most shared full videos about Ma Crossover Strategy. Since tradeWindow is false when the script calculates on a price bar within 3 bars of the current time and date, not before the variable gives us a true value in that case.