Blog Details

บทความ /

Blog Details

Judge Inform to own mr bet casino bonus Landlords and you will Possessions Managers

Articles

QIEs need fool around with Versions 1042 and you may 1042-S to possess a distribution to help you a good nonresident alien otherwise overseas company that’s treated while the a bonus, because the discussed earlier less than Certified financing entities (QIEs). More resources for the fresh withholding laws and regulations one connect with firms, trusts, estates, and you can accredited investment agencies, discover part 1445 plus the related legislation. For additional info on the fresh withholding laws one to apply at partnerships, understand the earlier conversation. Quite often, people shipping away from a QIE to help you a good nonresident alien, foreign corporation, or any other QIE that is attributable to the new QIE’s get out of the new product sales otherwise replace of an excellent USRPI are treated while the acquire acquiesced by the new nonresident alien, foreign company, or other QIE on the product sales otherwise change away from a great USRPI. When the a good transferee doesn’t withhold people matter necessary for Regulations section 1.1446(f)-2 concerning the the new transfer from a partnership focus, the relationship need to withhold regarding the distributions it makes to the transferee.

The newest international partner’s show of the partnership’s gross ECI is quicker because of the following the. The partnership may well not believe in the fresh certification when it features genuine education otherwise have reason to know that people information on the design is actually completely wrong or unsound. You can even request one more extension away from 1 month by the entry another Mode 8809 before the avoid of your basic extension several months. When requesting the other expansion, is a copy of the recorded Setting 8809.

(iv) The authority to have the services and you can/otherwise points included in the package from care. (iii) On the the amount practicable, the newest citizen have to be available with chances to take part in the new proper care considered process. (ii) The brand new resident keeps the legal right to exercise those legal rights not delegated so you can a resident affiliate, for instance the straight to revoke a good delegation out of liberties, except because the restricted to Condition rules. (2) The brand new citizen has the straight to end up being clear of disturbance, coercion, discrimination, and you will reprisal regarding the business inside workouts their rights and to getting backed by the brand new studio regarding the do it of his or her liberties as needed below that it subpart. (1) A facility must eliminate for each and every resident in accordance and you will self-respect and you can manage for every resident you might say and in a host you to encourages restoration otherwise enhancement from their particular top-notch lifetime, taking for each and every resident’s individuality. Starting a keen FCNR Put is quite seamless and you may much easier and will be achieved from the comfort of your property.

- Because the an enthusiastic NRI, you are making a twin income – one out of their country from house in the forex plus the most other from your own Indian investments inside the INR.

- Such, corporate distributions could be at the mercy of chapter step three withholding even though an integral part of the brand new shipment could be a profit of financing otherwise investment obtain that isn’t FDAP income.

- A resident out of a foreign country underneath the household blog post of an income tax pact are a good nonresident alien private to possess intentions away from withholding.

- The fresh mate ought to provide Setting 8804-C for the relationship to receive the fresh different from withholding.

- If your possessions transferred try owned as you by the U.S. and you may international people, the total amount know try assigned amongst the transferors according to the financing contribution of each transferor.

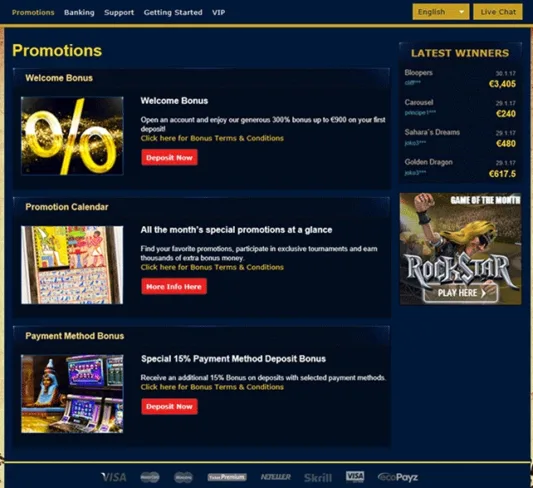

Mr bet casino bonus | Having fun with an intermediary

Although not, these number aren’t excused from withholding under part 4 when the interest are a great withholdable commission, unless of course a different of part 4 withholding enforce. So you can meet the requirements as the profile desire, the mr bet casino bonus interest should be paid on the financial obligation granted once July 18, 1984, and or even at the mercy of part step three withholding. In addition to, if interest offers have default, the newest tax have to be withheld to the terrible amount of interest whether or not the payment is an income away from investment otherwise the new payment cash. Regulators otherwise their businesses otherwise instrumentalities, any U.S. citizen or resident, one You.S. company, and you can people You.S. connection.

Other Provides, Prizes, and you may Awards At the mercy of Part 3 Withholding

The newest fee so you can a different company from the a foreign firm away from an excellent considered bonus lower than part 304(a)(1) are subject to section 3 withholding that will be an excellent withholdable payment except to your the amount it may be obviously determined so you can become of foreign supply. Alternatively, a payee can be permitted treaty pros beneath the payer’s treaty if there is a provision because pact one to enforce particularly to attention paid off by the payer foreign corporation. Particular treaties enable an exception whatever the payee’s residence otherwise citizenship, while some allow for an exception depending on the payee’s condition while the a citizen otherwise citizen of one’s payer’s nation. If the a keen NQI does not give you the payee particular allowance information for a good withholding rates pond or part 4 withholding price pond because of the January 31, you must not pertain the contrary process to the of the NQI’s withholding rate swimming pools from you to date give.

You can also end up being responsible as the a payer to have revealing repayments to a good U.S. individual, basically to the Mode 1099. You should keep back twenty four% (content withholding rate) out of particular reportable money designed to a great U.S. person that try at the mercy of Form 1099 reporting or no from another implement. NRIs must pay taxes according to the Indian tax law in the nation on the the money made in the Asia.

NRI Membership Professionals You must know

Income in the efficiency out of features by an excellent nonresident alien in the exposure to the individuals short term presence in the usa while the a normal person in the newest crew out of a foreign vessel interested within the transport involving the You and you will a foreign country otherwise a good U.S. territory isn’t earnings away from U.S. offer. For many who have confidence in your real knowledge about a payee’s status and you may keep back an amount below one expected beneath the presumption legislation or don’t statement a fees that is at the mercy of reporting within the presumption legislation, you’re liable for taxation, attention, and charges. You ought to, yet not, believe in your own genuine degree in the event the performing this contributes to withholding an expense higher than manage pertain underneath the expectation laws and regulations otherwise inside revealing an amount who does not be at the mercy of revealing beneath the expectation regulations. You can even, however, rely on documentary facts since the starting an account holder’s claim out of less price out of withholding under a good treaty if any out of next apply. You have got reason to understand that documentary proof try unreliable otherwise wrong to ascertain an immediate account holder’s position as the a foreign individual if any of one’s following apply.

Fixed Put Cost in the India for NRI: NRE FD

(b) The new costs will be uniform round the all twigs as well as for all the people so there will be zero discrimination when it concerns attention paid off to the dumps, ranging from one to deposit and another of similar amount, accepted for a passing fancy day, any kind of time of its workplaces. (xv) “RFC account” mode a citizen Forex membership referred to inside Forex Management (Foreign currency accounts because of the a guy resident within the Asia) Regulations, 2000, as the amended from time to time. We really do not post any bills, but for your convenience, you can use all of our online citizen webpage to test what you owe at any time. All people be able to perform an internet, safer membership due to resident webpage. Residents also provide the ability to create a repeating percentage because of their resident webpage. Please get in touch with any office when you yourself have concerns on the on the web membership, or how to create a profile.

Your property could be repossessed unless you carry on repayments on your financial. A few British lenders have said they’ll give 5% deposit mortgage loans, starting in April. The goal of great britain bodies’s 5% deposit mortgage scheme is to obtain lenders giving 95% LTV mortgages once more.